Take Control of Your Finances Today! Request Your FREE, No-Obligation Consultation!

Troubles Familiar? You've Arrived at the Solution

Nliven’s premier services are tailored to address your diverse concerns in business financial accounting. Explore our comprehensive range of solutions designed to meet your unique needs.

Federal & Income Tax Preparation Services

- Navigating through intricate tax codes, our skilled professionals ensure impeccable compliance with tax laws and regulations.

- Our adept tax strategists employ a range of deductions, credits, and exemptions to optimize your tax liability.

- Utilizing our in-depth understanding of tax brackets, we minimize your tax burden while ensuring adherence to prevailing tax rates.

- Timely filing of tax returns is a hallmark of our service, ensuring you avoid penalties and interest charges.

Bid farewell to tax-related stress and potential errors. Our tax preparation services offer peace of mind, enabling you to maximize your financial efficiency while staying compliant with tax laws.

Financial Statement Preparation Services

- Our dedicated team meticulously prepares financial statements in strict adherence to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

- We craft comprehensive balance sheets, income statements, and cash flow statements that provide an insightful view of your financial health.

- Highlighting key financial ratios and metrics, our expertise aids informed decision-making.

- Leveraging accrual accounting, we ensure the accurate recognition of revenue and expenses, offering a true reflection of your business’s financial position.

Say goodbye to the haze of financial ambiguity. Our expertly prepared financial statements empower you to make informed decisions, guiding your business

strategy with confidence.

strategy with confidence.

Payroll Management Services

- With our comprehensive payroll management, we calculate gross pay, encompassing regular pay, overtime, and bonuses.

- Expertly deducting federal and state income taxes, Social Security, and Medicare taxes, we ensure accurate and compliant payrolls.

- Our meticulous approach ensures the timely deposit of payroll taxes and filing of tax returns, relieving you of administrative burdens.

- Maintaining precise payroll records, we adhere to recordkeeping requirements while ensuring your employees are compensated accurately.

Eliminate the headache of payroll intricacies and the looming threat of tax penalties. With our payroll management services, you can confidently invest your time and energy in scaling your business.

General Bookkeeping Services

- Employing the fundamental principles of double-entry bookkeeping, we meticulously record every financial transaction twice, ensuring accuracy.

- Our proficient bookkeepers create a comprehensive general ledger that categorizes transactions into accounts, facilitating systematic organization.

- Generating trial balances, we ensure the equality of debit and credit balances, a critical step in maintaining financial accuracy

- This foundational service provides a solid basis for the creation of income statements and balance sheets, aiding meaningful financial reporting.

Unravel financial intricacies and keep your records crystal clear. Our general bookkeeping services lay the groundwork for your financial insights, helping you maintain accurate records for better decision-making.

Sales and Use Tax Preparation

- Expertly calculating sales and use taxes, we consider transactional data and prevailing tax rates to ensure precise tax reporting.

- Our meticulous approach ensures compliance with Value Added Tax (VAT) or Goods and Services Tax (GST) regulations, preventing errors and penalties.

- Thorough tax return preparation and timely tax remittance reflect our commitment to maintaining tax compliance in a dynamic regulatory environment.

Wave goodbye to the stress of navigating complex sales and use tax regulations. Our preparation services offer peace of mind, allowing you to focus on growing your business while staying compliant with tax laws.

Reconciliation Services

- Conducting meticulous bank reconciliation, our skilled professionals match internal records with bank statements, identifying discrepancies.

- This process adheres to Generally Accepted Auditing Standards (GAAS) and audit readiness principles, ensuring accuracy and transparency.

- Reconciling accounts receivable and accounts payable, we validate payment accuracy, enhancing financial clarity.

- Our reconciliation expertise extends across various financial aspects, upholding the integrity of your financial records.

Bid farewell to financial discrepancies and ensure your records are accurate and reliable. Our reconciliation services provide a clean slate for your financial data, enabling you to make informed decisions based on solid foundations.

Other Accounting Services

- Our suite of specialized accounting solutions, including forensic accounting and cost accounting, addresses unique business needs.

- Leveraging activity-based costing (ABC) methodologies, we allocate overhead costs accurately to enhance cost management strategies.

- Our adaptable approach extends to industry-specific accounting standards, ensuring our services align seamlessly with your business requirements.

Address specific financial challenges head-on. With our industry expertise, we customize solutions that precisely align with your business goals, ensuring your financial management is both effective and efficient.

- Federal & Income Tax Preparation Services

- Financial Statement Preparation Services

- Payroll Management Services

- General Bookkeeping Services

- Navigating through intricate tax codes, our skilled professionals ensure impeccable compliance with tax laws and regulations.

- Our adept tax strategists employ a range of deductions, credits, and exemptions to optimize your tax liability.

- Utilizing our in-depth understanding of tax brackets, we minimize your tax burden while ensuring adherence to prevailing tax rates.

- Timely filing of tax returns is a hallmark of our service, ensuring you avoid penalties and interest charges.

Bid farewell to tax-related stress and potential errors. Our tax preparation services offer peace of mind, enabling you to maximize your financial efficiency while staying compliant with tax laws.

- Our dedicated team meticulously prepares financial statements in strict adherence to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

- We craft comprehensive balance sheets, income statements, and cash flow statements that provide an insightful view of your financial health.

- Highlighting key financial ratios and metrics, our expertise aids informed decision-making.

- Leveraging accrual accounting, we ensure the accurate recognition of revenue and expenses, offering a true reflection of your business’s financial position.

Say goodbye to the haze of financial ambiguity. Our expertly prepared financial statements empower you to make informed decisions, guiding your business

strategy with confidence.

strategy with confidence.

- With our comprehensive payroll management, we calculate gross pay, encompassing regular pay, overtime, and bonuses.

- Expertly deducting federal and state income taxes, Social Security, and Medicare taxes, we ensure accurate and compliant payrolls.

- Our meticulous approach ensures the timely deposit of payroll taxes and filing of tax returns, relieving you of administrative burdens.

- Maintaining precise payroll records, we adhere to recordkeeping requirements while ensuring your employees are compensated accurately.

Eliminate the headache of payroll intricacies and the looming threat of tax penalties. With our payroll management services, you can confidently invest your time and energy in scaling your business.

- Employing the fundamental principles of double-entry bookkeeping, we meticulously record every financial transaction twice, ensuring accuracy.

- Our proficient bookkeepers create a comprehensive general ledger that categorizes transactions into accounts, facilitating systematic organization.

- Generating trial balances, we ensure the equality of debit and credit balances, a critical step in maintaining financial accuracy

- This foundational service provides a solid basis for the creation of income statements and balance sheets, aiding meaningful financial reporting.

Unravel financial intricacies and keep your records crystal clear. Our general bookkeeping services lay the groundwork for your financial insights, helping you maintain accurate records for better decision-making.

- Expertly calculating sales and use taxes, we consider transactional data and prevailing tax rates to ensure precise tax reporting.

- Our meticulous approach ensures compliance with Value Added Tax (VAT) or Goods and Services Tax (GST) regulations, preventing errors and penalties.

- Thorough tax return preparation and timely tax remittance reflect our commitment to maintaining tax compliance in a dynamic regulatory environment.

Wave goodbye to the stress of navigating complex sales and use tax regulations. Our preparation services offer peace of mind, allowing you to focus on growing your business while staying compliant with tax laws.

- Conducting meticulous bank reconciliation, our skilled professionals match internal records with bank statements, identifying discrepancies.

- This process adheres to Generally Accepted Auditing Standards (GAAS) and audit readiness principles, ensuring accuracy and transparency.

- Reconciling accounts receivable and accounts payable, we validate payment accuracy, enhancing financial clarity.

- Our reconciliation expertise extends across various financial aspects, upholding the integrity of your financial records.

Bid farewell to financial discrepancies and ensure your records are accurate and reliable. Our reconciliation services provide a clean slate for your financial data, enabling you to make informed decisions based on solid foundations.

- Our suite of specialized accounting solutions, including forensic accounting and cost accounting, addresses unique business needs.

- Leveraging activity-based costing (ABC) methodologies, we allocate overhead costs accurately to enhance cost management strategies.

- Our adaptable approach extends to industry-specific accounting standards, ensuring our services align seamlessly with your business requirements.

Address specific financial challenges head-on. With our industry expertise, we customize solutions that precisely align with your business goals, ensuring your financial management is both effective and efficient.

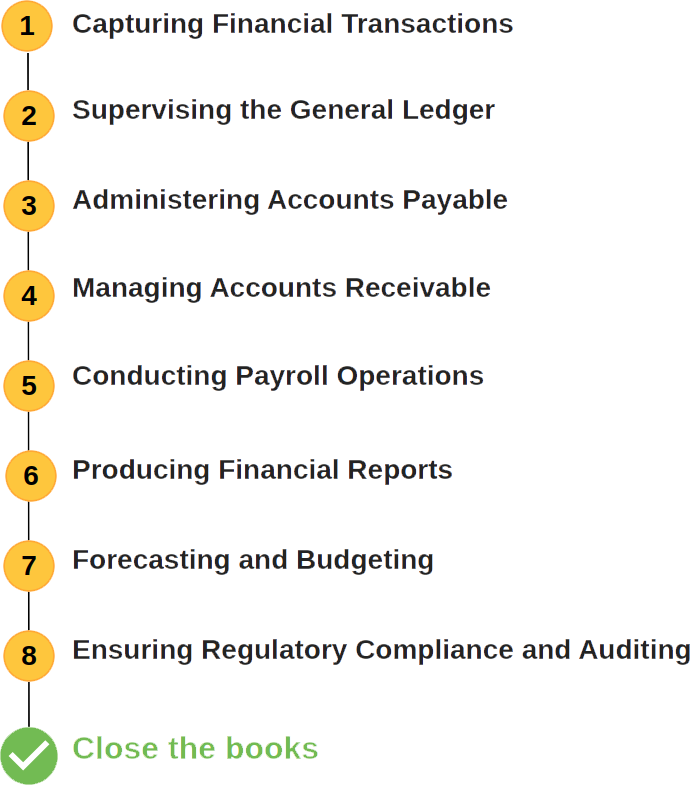

Our Structured Accounting Process

Discover the systematic approach we follow to manage our clients’ accounting requirements.

Capturing Financial Transactions

Recording all monetary activities to track financial movement accurately.

Supervising the General Ledger

Managing the central repository of financial data for a comprehensive overview.

Administering Accounts Payable

Handling and processing outgoing payments to vendors and suppliers.

Managing Accounts Receivable

Tracking and managing incoming payments from customers and clients.

Conducting Payroll Operations

Ensuring timely and accurate employee compensation and deductions.

Producing Financial Reports

Creating detailed reports that offer insights into financial health.

Forecasting and Budgeting

Projecting future financial scenarios and planning budgets.

Ensuring Regulatory Compliance and Auditing

Adhering to legal standards and undergoing audits for transparency.

Close the books

Finalizing all financial transactions and ensuring accuracy in financial records.

Curious to Witness How Our Approach Elevates Your Business?

Leading Accounting Software Tools in Our Arsenal

Experience the power of widely recognized accounting tools integrated seamlessly into our processes. If your preferred tool isn’t listed, rest assured, we’re adaptable.

Expertise in one software empowers us to navigate others effectively, ensuring your financial needs are met efficiently.

Expertise in one software empowers us to navigate others effectively, ensuring your financial needs are met efficiently.

Navigating Global Accounting Standards with Expertise

Our proficiency spans across a spectrum of Accounting Standards, ensuring precision and compliance for your financial needs. And if your specific accounting standard isn’t mentioned here, don’t worry. We’re equipped to swiftly adapt and offer expertise in additional standards. Your financial accuracy is our commitment.

Employed in the United States and numerous other countries, GAAP is the bedrock of financial reporting, ensuring consistency and transparency.

A globally recognized framework followed by

over 125 countries, IFRS ensures a harmonized approach to financial reporting, facilitating cross-border comparisons.

over 125 countries, IFRS ensures a harmonized approach to financial reporting, facilitating cross-border comparisons.

Guiding financial reporting in Australia, AASB

promotes uniformity, transparency, and

credibility

promotes uniformity, transparency, and

credibility

Global Reach, Local Excellence: Our Diverse Clientele

Discover the widespread presence of our esteemed clientele, spanning across multiple countries.

Commitment to Privacy: Upholding the utmost confidentiality, we prioritize your privacy. Rest assured, client discretion is a cornerstone of our approach. Your trust is paramount, and we respect your choice for confidentiality.

Commitment to Privacy: Upholding the utmost confidentiality, we prioritize your privacy. Rest assured, client discretion is a cornerstone of our approach. Your trust is paramount, and we respect your choice for confidentiality.

View More

Accounting Services in USA

Accounting Services in Australia

Accounting Services in Saudi Arabia

Accounting Services in US Virgin Islands

Accounting Services in British Virgin Island

Accounting Services in UK

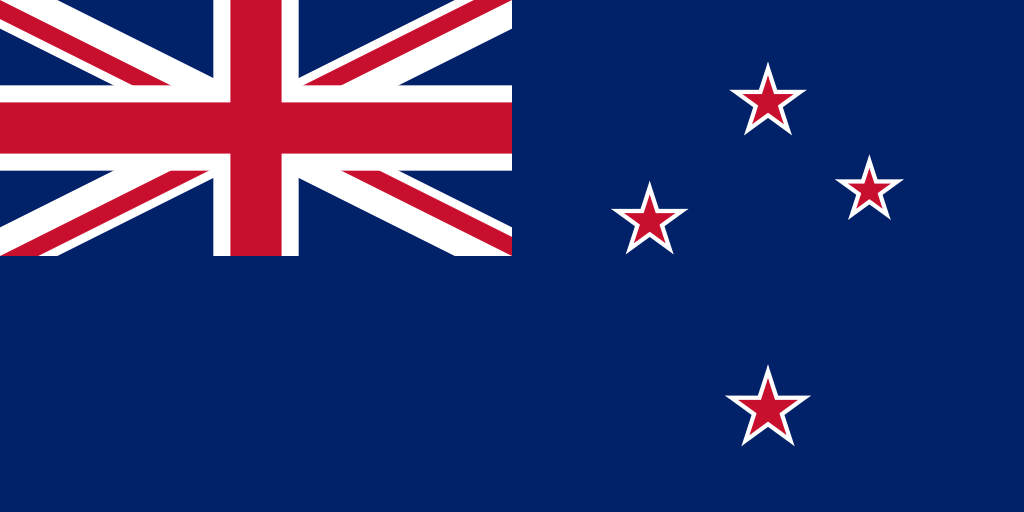

Accounting Services in New Zealand

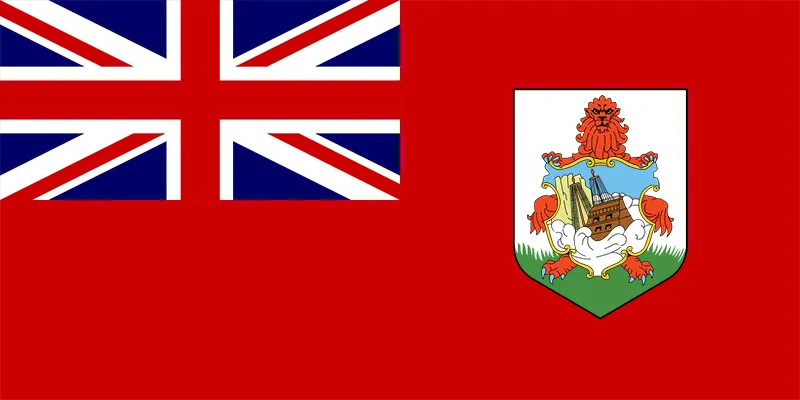

Accounting Services in Bermuda

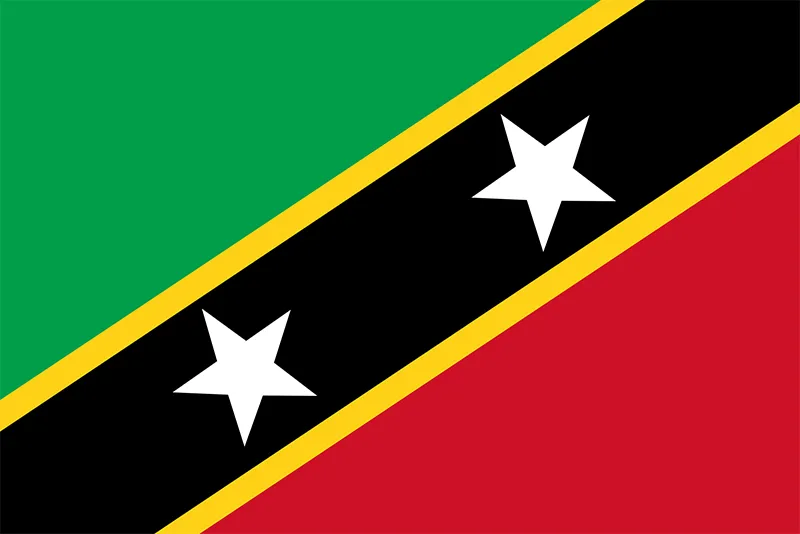

Accounting Services in St. Kitts & Nevis

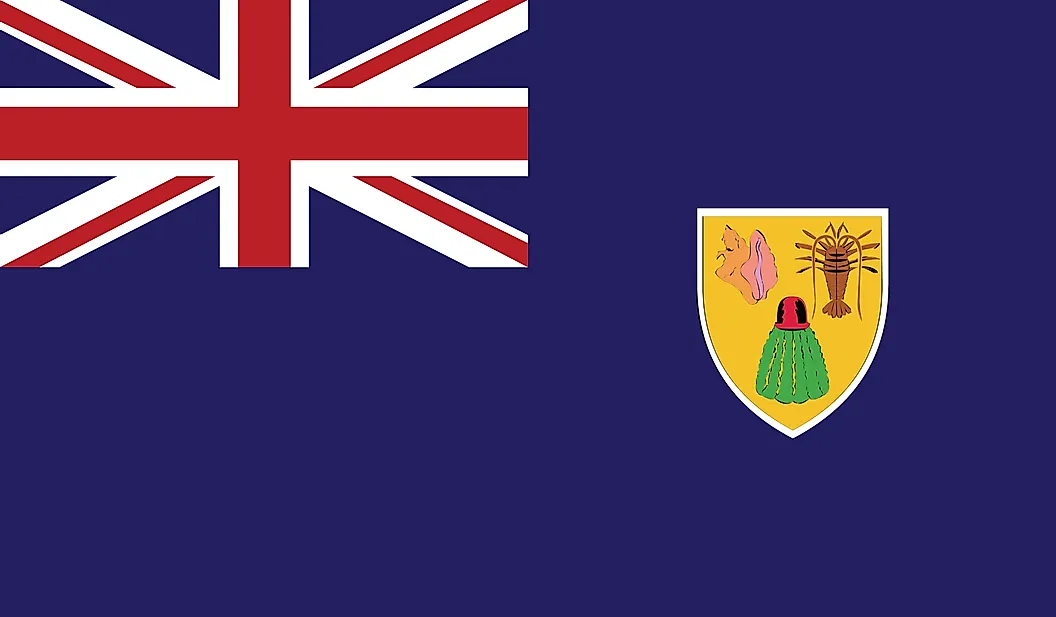

Accounting Services in Turks & Caicos

Accounting Services in Canada

Accounting Services in Singapore

Accounting Services in Cayman Islands

Accounting Services in Anguilla

Accounting Services in Saint Martin

Accounting Services in UAE

Accounting Services in Qatar

Accounting Services in Bahamas

Accounting Services in Barbados

Accounting Services in Jamaica

Achieve More with Nliven: Uncover the Benefits of Outsourcing Excellence

Working with Nliven Accounting Outsourcing Services provides a range of benefits that can greatly enhance your business operations and financial management. Here’s an outline of some key benefits:

Expert Financial Knowledge:

Access to a team of experienced financial professionals with deep expertise in various industries and accounting practices.

Time and Resource Savings:

Outsourcing your financial tasks allows you to focus on core business activities, reducing the time and resources spent on accounting and bookkeeping.

Cost Efficiency:

Eliminate the need to hire and train in-house accountants, saving on employee salaries,

benefits, and infrastructure costs.

benefits, and infrastructure costs.

Accuracy and Compliance:

Ensure accurate financial reporting and tax compliance, minimizing the risk of errors and

penalties associated with regulatory violations.

penalties associated with regulatory violations.

Scalability:

Easily scale your accounting services up or down as your business evolves, without the

hassle of hiring or letting go of staff.

hassle of hiring or letting go of staff.

State-of-the-Art Technology:

Access to advanced accounting software and tools that streamline processes, enhance

data accuracy, and provide real-time financial insights.

data accuracy, and provide real-time financial insights.

Strategic Financial Planning:

Leverage financial data to make informed business decisions, develop growth strategies,

and identify opportunities for cost savings.

and identify opportunities for cost savings.

Focus on Growth:

Free up your time and mental bandwidth to focus on business growth, innovation, and

strategic initiatives.

strategic initiatives.

Data Security:

Benefit from secure data management practices and protocols that safeguard sensitive financial information.

Reduced Stress:

Delegate complex financial tasks to experts, reducing stress and allowing you to concentrate on what you do best.

Customized Solutions:

Tailored financial solutions that meet your specific needs and align with your business goals and objectives.

Improved Cash Flow Management:

Better manage cash flow and working capital with the help of experts who can optimize

financial processes.

financial processes.

Access to Insights:

Gain valuable insights into your business’s financial health, performance, and areas for

improvement.

improvement.

Peace of Mind:

Enjoy the peace of mind that comes with knowing your financial processes are in capable hands.

Working with Nliven Outsourcing Services ensures that your business’s financial needs are met with precision, expertise, and efficiency, allowing you to concentrate on achieving your business objectives and driving growth.